Don’t Simply Retire. Have Something to Retire to.

Introducing THE Kai Zen Strategy

Your retirement will cost you an average of 6 times more than your house. Most people use financing to live in a better house, so why aren’t you using financing to help you fund a better retirement?

What Will Your Retirement Look Like?

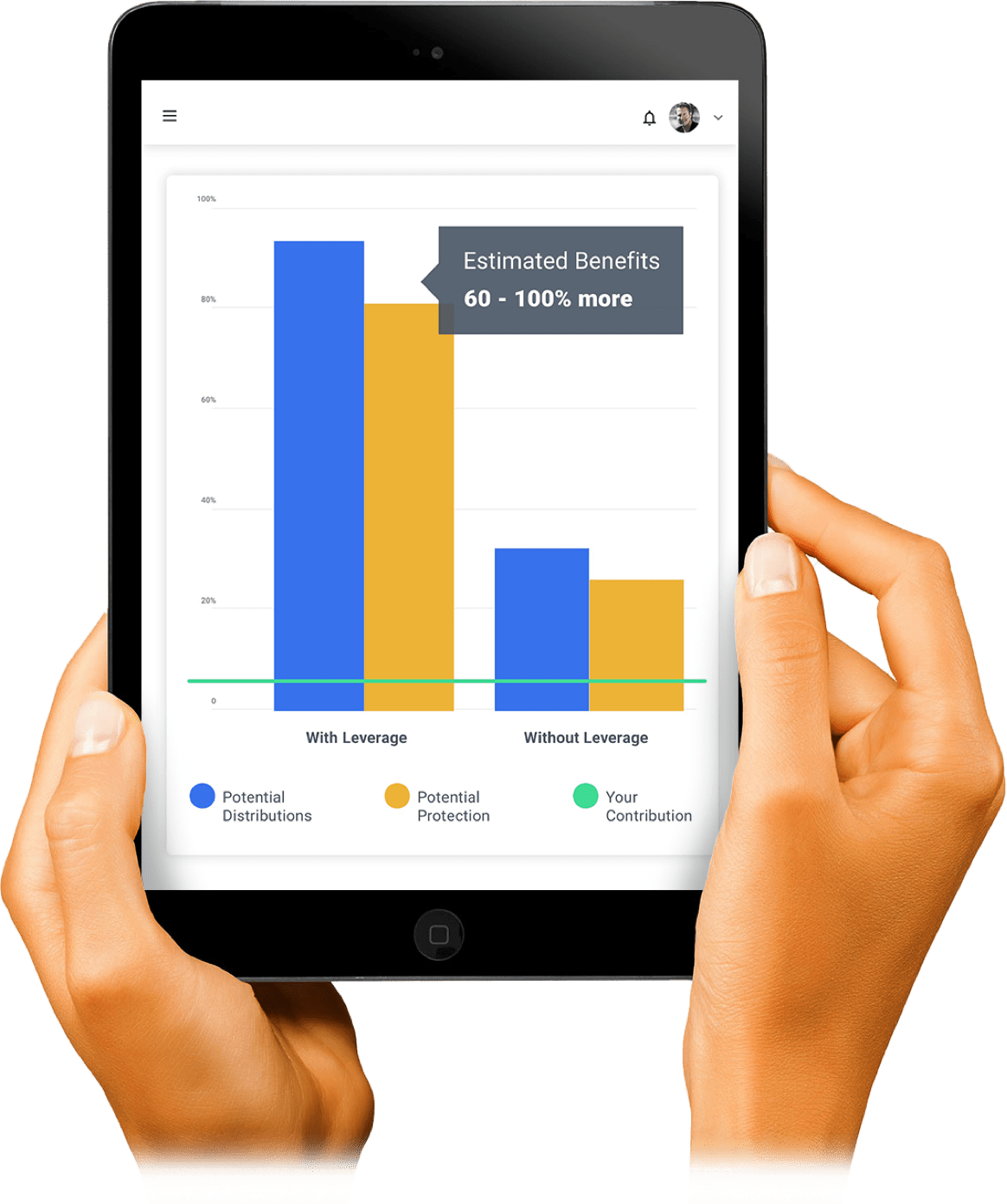

The success of your retirement depends on the amount you save, not on your rate of return. A unique cash accumulating life insurance policy using leverage offers an opportunity to earn interest and eliminate the risk of market declines, while providing you and your family protection. The policy secures the loan, providing you the potential for an additional 60-100% more for your retirement without the typical risks associated with leverage.

Why using leverage is smart.

We have all used leverage to purchase a nicer house or to buy a better car.

Kai Zen uses leverage for the potential to accumulate more growth & obtain more protection, while providing the ability to maintain your current standard of living. That’s the smart way to use leverage.

Potential for more accumulation

Maintain current lifestyle.

More protection for you and your family.

Diversify your assets

Kai-Zen® is different!

Kai-Zen®

is the only strategy that provides you the opportunity to add up to 3 times more money to fund a cash accumulating life insurance policy. Your contribution and the policy provide the security needed to obtain the loan and your participation is easy. Simply create an account, estimate your short 5-year annual contribution amount, and let Kai-Zen®

leverage do the rest.

Kai-Zen®

was designed to minimize expenses and maximize your potential for accumulation. We then combined it with leverage to provide you the potential for 60-100% more:*

THE Kai Zen advantage:

Smart Leverage

No Credit Checks

No Loan Documents

No Personal Guarantees

No Interest Payments

More Protection

Death Benefit (with living benefit riders)

Chronic Illness

Terminal Illness

More Potential Growth

Upside Crediting (subject to cap)

No Negative Returns (no loss due to market declines)

Tax-Free Distributions (potential to access cash value using tax-free policy loans)

BJF INSURANCE SERVICES

P.O. Box 1318, Genoa, CA 89411

brad.fiene@bjfinsuranceservices.com

kyle.fiene@bjfinsuranceservices.com